MARKETING: THE BIOCHEMISTRY OF RAISING ASSETS

In Saturday morning’s note I wrote about the need for alternative asset managers and the industry as a whole to restore TRUST. In my opinion, that objective is an existential imperative.

The most important decisions in our lives are emotionally driven. I’ve yet to see an algorithm or spreadsheet that someone used to pick a Wife or Husband as well as decide to have children! ALL are emotionally-driven but data-supported decisions with enormous impact on the current and future quality of each person’s life. Manager selection and allocation decisions are no different! Despite the transactional nature of investing and the emphasis on numbers and quantitative metrics, we are in a people business driven by TRUSTED relationships and the more significant the decision the more TRUST comes into play.

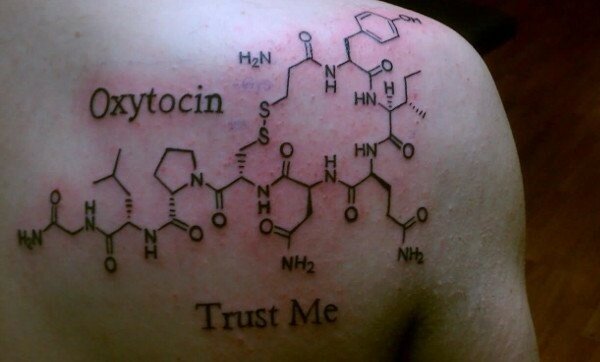

Neuroeconomist Paul J. Zak, PhD, a pioneer in the field of oxytocin research, professor at Claremont College and author of the book, “The Moral Molecule: Vampire Economics and the New Science of Good and Evil”, says that “TRUST is the lubricant that makes economic transactions possible”. Zak had a TED Talk titled “Trust, Morality and Oxytocin?” that’s been viewed more than 1.4 million times. You might want to check it out!

It wasn’t until European nations could agree on standard weights and measures, which facilitated TRUST, that trade and commerce flourished. While it may say “In God We Trust” on U.S. currency, what we are really trusting is that a piece of tangible paper or metal or nowadays in digital representation (crypto-currency) is worth what we all believe it’s worth. In his research, Zak discovered “Where there is more trustworthiness, there is more prosperity,”.

But why do two people trust each other in the first place?

Research shows that there’s a neurologic signal that indicates when we should TRUST someone! The signal is from Oxytocin, known as “the trust hormone”. Oxytocin is produced by the hypothalamus and secreted by the pituitary gland. It appears that among the many things that oxytocin does is reduce the fear of trusting a stranger. For example, a high stress climate (crisis!) is a potent oxytocin inhibitor. Most people intuitively know this: When they are stressed out, they do not interact with others effectively. Stephen Covey, the well-known author of the book “The 7 Habits of Highly Effective People”, states “TRUST is the glue of life!”. TRUST influences not only WHAT we buy but WHEN we buy and WHO we buy from!

For an investment manager to acquire and retain assets under management requires INVESTOR TRUST – and a lot if it at that, because there must be enough trust present (what I refer to as “actionable conviction“) within the “relationship” to allow for open and transparent communication to occur This type of communication is much deeper, and it includes discussions around fears, personal challenges, barriers, short-term agendas, as well as longer-term goals. Given the current personal, social and business limitations now in place due to COVID-19, in the absence of in-person interactions, gaining trust is more difficult! What every manager/fund must do now is create “DIGITAL OXYTOCIN“, as the communication mechanisms will be online (Videos, Zoom, Gotowebinar, Webex, etc.) due to restrictions and limitations of in-person meetings.

6 tactical tips to increase prospect oxytocin:

1. Build trust before you engage. Before you pick up a phone to make a call or send an email, learn about the recipient holistically, both qualitatively and quantitatively – find out about their life, what is important to them and what is not. Also, enable to them learn things about you too by showing who you are as a person as well as what’s important to you as an individual and firm.

2. Communicate effectively and openly. Be clear, consistent and coherent. Avoid saying one thing and doing another – but if you have to, because circumstances have changed, be transparent and honest.

3. Share your knowledge and demonstrate competence. Investors seek partnerships with asset managers that embody the attributes of being “a firm with individuals that can be TRUSTED”. They must know you are not only highly-skilled but someone trustworthy when they allocate capital and entrust their wealth.

4. Walk the talk. If you state in your marketing material how important certain values are to you and the firm, make sure you reflect and affirm those values in every touchpoint with the prospect. YOU are the role model.

5. Show your human side. Share how you’ve overcome personal and professional challenges. This will show you have what it takes to stick with it when markets get tough and/or performance drops, that you won’t fold up and close up! Who wants to do business with a quitter?!! Don’t worry about appearing weak! People can relate to imperfections as well as strengths, no one likes a “know-it-all” or someone that can’t admit mistakes!

6. Show people what you value and respect about them. Investors are idiosyncratic. Most people have rich stories about WHO they are! Understand their unique journey along with their ethics, values and passions as well as the challenges they have faced! To the extent possible, support their goals and have their back in crisis!

What is the tactical action point?

ALL BUYING IS EMOTIONAL. PERIOD. FULL STOP.

Increase Oxytocin To Build Trust & Raise (Retain) Assets.

Remember: We are all in this together and will come through it TOGETHER!

Continued Success, Stay Calm and EXECUTE!

As always, I hope you find this helpful.

Bryan Johnson

Managing Partner

Johnson & Company

Direct: (512) 786-1569 or [email protected]

“Marketing Alpha” For Sub-Institutional Hedge Funds.

www.johnsn.com